Frequently Asked Questions

Frequently Asked Questions

Investment banking FAQs

When a company goes public or lists in the Philippine Stock Exchange, it is able to raise capital which the company may need for various reasons. In addition, doing an IPO increases a company’s visibility and allows the company to attract skilled and top personnel.

There are legal, accounting, and significant compliance and reportorial requirements to the Securities and Exchange Commission (SEC) as well as to the Philippine Stock Exchange (PSE). As such, it’s important to work with an underwriter who can provide guidance regarding the process.

The timing will depend on a company’s need for cash or liquidity to pursue its strategic plans as well as its readiness to comply with the requirements of going public.

There are essentially three (3) main stages. Stage 1 is the pre-filing stage or working towards deciding on the IPO. Stage 2 is the pre-effective stage wherein the company is now under review by the regulators. The company can do some market sounding however, actively marketing is not allowed. Stage 3 is the pricing and post-effective stage which happens when the transaction is declared effective by the SEC and the PSE and active marketing is now allowed.

An IPO team is composed of an underwriter or underwriters, external class A accountants, legal counsel or counsels, research analysts, receiving and stock transfer agent, who work with the company throughout the entire process.

Financing FAQs

- Short-Term Business Loan

- Receivables Discounting

- Revolving Credit Line

- Motorcycle Fleet Financing

- Corporate Salary Loan

- Personal Salary Loan

- Seafarer’s Loan

- Others

Short-Term Business Loan

To apply, you can:

- Submit an application online by filling out this form.

- Call our office directly through our landline: (632) 8892-0991.

- Visit our office located at 3/F Majalco Building, Benavidez cor. Trasierra St., Makati City, Philippines to submit your complete application form and documents.

To qualify, you must meet the following criterias:

- Borrower must have an existing business operating for at least one (1) year.

- Borrower must have an active checking account for at least six (6) months (with no more than 3 return checks for the past six (6) months).

- Business must be registered with DTI or SEC.

- Business must be located and operating within the following areas:

- Metro Manila

- Batangas

- Laguna

- Cavite

- Rizal

- Pampanga

- Bulacan

- Borrower’s average monthly gross sales is at least PHP250,000.

- Borrower’s latest credit ratio must be 50% and below.

The documentary requirements you need to submit will depend on your business type (sole proprietorship, partnership, corporation). Please see the full list below.

Standard requirements:

- Duly filled-out and signed UFII Application Form including Authority to Verify Borrower’s Bank Accounts

- Photocopy of SSS ID and/or any other government-issued ID of the principal borrower

- Photocopy of latest 6 months Bank Statements and Bank Certification

- Photocopy of Valid Barangay Business Clearance

- Photocopy of Valid Mayor’s Permit

- 2 x 2 Picture of the Principal Borrower

- Picture of the Exterior and Interior of the Business with Business Signage

- Photocopy of Proof of Billing (not older than 2 months) for residence and business (ex. electric, water, internet, rent billing)

- Photocopy of Income Tax Return (Optional)

Additional for Sole Proprietorship:

- DTI Certificate of Business Name Registration

Additional requirements for Partnership:

- SEC Certificate of Incorporation

- Latest Articles of Partnership

- Partner’s Resolution

- Surety of Partners will be required

Additional requirements for Corporation:

- SEC Certificate of Incorporation

- Latest Articles of Partnership

- Latest General Information Sheet (GIS)

- Secretary’s Certificate relative to the loan documents to be signed by the Borrower to UFII (To be submitted prior to release of the approved loan).

- Surety of Majority Owners

As soon as you submit the complete and correct documentary requirements as your application, our credit team will process them within 7 business days.

Our maximum interest rate per month is 3%. The final rate will depend on your credit evaluation results.

Receivables Discounting

To apply, you can:

- Submit an application online by filling out this form.

- Call our office directly through our landline: (632) 8892-0991.

- Visit our office located at 3/F Majalco Building, Benavidez cor. Trasierra St., Makati City, Philippines to submit your complete application form and documents.

To qualify, you must meet the following criterias:

- Borrower must have an existing business operating for at least three (3) years.

- Borrower must have an active checking account for at least six (6) months

- Borrower must have a Financial Statement (FS) for the past two years

- Business must be registered with DTI or SEC

- Business must be located and operating within the following areas:

- Metro Manila

- Batangas

- Laguna

- Cavite

- Rizal

- Pampanga

- Bulacan

- Borrower’s average monthly gross sales is at least PHP1,000,000.

- Borrower’s latest credit ratio must be 50% and below.

Please see the full list below:

- UFII Duly filled-out and signed Application Forms

- Photocopy of two (2) government-issued IDs of the principal borrower

- Photocopy of latest 6 months Bank Statements & Latest 3 years ITR with AFS

- Photocopy of valid Mayor’s Permit and Barangay Permit

- Picture of the Exterior and Interior of the Business and sketched map of business location

- Photocopy of Proof of Billing (not older than 2 months) for residence and business (ex. electric, water, internet, rent billing)

- Copy of business registration ( DTI Certificate of Business Name Registration or SEC Certificate of Incorporation)

- For corporation and partnership, please submit a copy of latest GIS and Articles of Incorporation and By-laws

For clean loans (non-collateral), interest rate per annum ranges from 18% to 24%.

For secured loans (with collateral), interest rate per annum ranges from 12% to 15%.

Revolving Credit Line

To apply, you can:

- Submit an application online by filling out this form.

- Call our office directly through our landline: (632) 8892-0991.

- Visit our office located at 3/F Majalco Building, Benavidez cor. Trasierra St., Makati City, Philippines to submit your complete application form and documents.

To qualify, you must meet the following criterias:

- Borrower must have an existing business operating for at least three (3) years.

- Borrower must have an active checking account for at least six (6) months

- Borrower must have a Financial Statement (FS) for the past two years

- Business must be registered with DTI or SEC

- Business must be located and operating within the following areas:

- Metro Manila

- Batangas

- Laguna

- Cavite

- Rizal

- Pampanga

- Bulacan

- Borrower’s average monthly gross sales is at least PHP1,000,000.

- Borrower’s latest credit ratio must be 50% and below.

Please see the full list below:

- UFII Duly filled-out and signed Application Forms

- Photocopy of two (2) government-issued IDs of the principal borrower

- Photocopy of latest 6 months Bank Statements & Latest 3 years ITR with AFS

- Photocopy of valid Mayor’s Permit and Barangay Permit

- Picture of the Exterior and Interior of the Business and sketched map of business location

- Photocopy of Proof of Billing (not older than 2 months) for residence and business (ex. electric, water, internet, rent billing)

- Copy of business registration ( DTI Certificate of Business Name Registration or SEC Certificate of Incorporation)

- For corporation and partnership, please submit a copy of latest GIS and Articles of Incorporation and By-laws

For clean loans (non-collateral), interest rate per annum ranges from 18% to 24%.

For secured loans (with collateral), interest rate per annum ranges from 12% to 15%.

Motorcycle Fleet Financing

To apply, you can:

- Submit an application online by filling out this form.

- Call our office directly through our landline: (632) 8892-0991.

- Visit our office located at 3/F Majalco Building, Benavidez cor. Trasierra St., Makati City, Philippines to submit your complete application form and documents.

To qualify, you must meet the following criterias:

- Business must be operating for at least three (3) years and is profitable as seen on audited Financial Statements for the past two (2) years

- Business must be registered with the DTI or SEC and with updated permits and licenses to operate

- Business must be located and operating within the following areas:

- Metro Manila

- Batangas

- Laguna

- Cavite

- Rizal

- Pampanga

- Bulacan

- Borrower can submit the latest three (3) years Annual Financial Statements and latest six (6) months bank statements

- Principal owner/s and the institution must have good credit standings

- Principal owner/s are here in the country are/is willing to submit their latest SALN and sign the surety agreement for the credit line (prior to approval).

Please see the full list below:

Minimum of 12% per annum to Maximum of 18% add-on rate

Corporate Salary Loan

To apply, you can:

- Submit an application online by filling out this form.

- Call our office directly through our landline: (632) 8892-0991.

- Visit our office located at 3/F Majalco Building, Benavidez cor. Trasierra St., Makati City, Philippines to submit your complete application form and documents.

To qualify, you must meet the following criterias:

- Borrower must be a permanent employee of the accredited company with tenures of at least one (1) year and are of good moral standing.

- Principal borrower must be able to provide a co-maker

- Casual or contractual employees can be considered for a loan with a loan term 60 days less than end of contract and with a corporate guarantee from the employer

- Employees should not be due for retirement within a period of 5 (five) years

Please see the full list below:

Interest rate is 12% per annum add-on rate

Personal Salary Loan

To apply, you can:

- Submit an application online by filling out this form.

- Call our office directly through our landline: (632) 8892-0991.

- Visit our office located at 3/F Majalco Building, Benavidez cor. Trasierra St., Makati City, Philippines to submit your complete application form and documents.

To qualify, you must meet the following criterias:

- Borrower’s basic salary should be at least PHP 30,000

- Borrower should be in good credit standing

Please see the full list below:

Interest rate is 24% per annum add-on rate

Seafarer’s Loan

To apply, you can:

- Submit an application online by filling out this form.

- Call our office directly through our landline: (632) 8892-0991.

- Visit our office located at 3/F Majalco Building, Benavidez cor. Trasierra St., Makati City, Philippines to submit your complete application form and documents.

To qualify, you must meet the following criterias:

- Borrower must have a valid contract of deployment for at least six (6) months with POEA accredited/selected manning agency

- Borrower must be 21 to 50 years old only

- Borrower must be a permanent resident with a permanent address in the Philippines. If the borrower is renting, he must provide a proof of continuous residency of at least one (1) year.

- Borrower must be in good credit standing

Please see the full list below:

Interest rate is 24% per annum add-on rate

Others

Fees depend on the type of loan facility. Standard fees will include documentary stamps, gross receipt tax, and loan evaluation fees. Credit life insurance fees may also apply.

The processing lead time varies and is dependent on the loan facility. Upon submission of complete and correct documentary requirements, for retail and consumer loans, processing time is three to five working days. For commercial loans where credit lines may need to be structured, processing time can range from fifteen to thirty days.

Our dedicated Sales Channel Officer will guide and assist you from application to release of your loan. You can expect to receive an update from them regularly especially if you are approved. In parallel, you will receive an email notification which contains the terms and conditions of your loan application in addition to the required next steps for loan availment.

You can pay your loan amortizations by providing us with post-dated checks (PDCs) or via our accredited payment centers or banks nationwide, as listed below:

- MLhullier

- Banco de Oro (BDO)

- Metrobank

- Chinabank

- Eastwest Bank

- UCPB

Securities FAQs

UTrade

Go to utradeph.com then click Register Now. Have your government-issued IDs ready before you do the online registration. In addition to a government-issued ID, have your Form W-9 ready for US residents for tax purposes or Form W-8BEN for entities not tax residents in the US and are the beneficial owners of income.

After successful registration, email your proof of initial investment to equities@unicapital-inc.com. Check out the instructions for funding your account below.

Yes, any individual or institution regardless of age and citizenship can open a trading account with Unicapital Securities, Inc. provided that all required information is disclosed and is acceptable in compliance with the existing rules and regulations. USI, however, reserves the right to reject an application as it sees fit.

The minimum initial investment is Php10,000. Like, follow, and subscribe to our social media accounts for account-opening discounts and promos.

The following are ways to fund your UTrade account:

- Deposits and Bank Transfers

- For over-the-counter deposits and bank transfers, and bank transfers using a mobile banking app, online banking platform, and e-wallet app, you can choose among the recipients below:

- Account Name: Unicapital Securities, Inc.

BDO Savings: 00360-000079-3

BPI Checking: 321-1084986

China bank Checking: 115143791-6

AUB: 533-01-000018-3

- Account Name: Unicapital Securities, Inc.

- For over-the-counter deposits and bank transfers, and bank transfers using a mobile banking app, online banking platform, and e-wallet app, you can choose among the recipients below:

- Bills Payment

- Bills payment is available at BDO, China Bank, and M. Lhuillier. You can do it over the counter, using the mobile banking app, or online banking facility. Bills payment using an ATM is also available at BDO. Below is the information needed:

- Biller/Subscriber Name: UTrade or Unicapital Securities, Inc.

- Biller/Reference/Subscriber Number: Your UTrade account code. It usually starts with the letters OL.

- Bills payment is available at BDO, China Bank, and M. Lhuillier. You can do it over the counter, using the mobile banking app, or online banking facility. Bills payment using an ATM is also available at BDO. Below is the information needed:

- Remittance

- If you reside outside the Philippines, we suggest making a remittance to your local bank account and making a mobile or online bank transfer from your local bank account to the bank account of Unicapital Securities, Inc. for faster crediting purposes. If a local bank account is not available, below are the details needed for remittance transactions:

- Account Name: Unicapital Securities, Inc.

Account Number: S/A 360-000079-3

Name of Bank: Banco de Oro

Branch: Ayala Triangle

Swift Code: BNORPHMM - Account Name: Unicapital Securities, Inc.

Account Number: C/A 321-1084986

Name of Bank: Bank of the Philippine Islands

Branch: Corinthian Plaza

Swift Code: BOPIPHMM - Account Name: Unicapital Securities, Inc.

Account Number: C/A 115143791-6

Name of Bank: China Banking Corp.

Branch: Legaspi-AIM

Swift Code: CHBKPHMM

- Account Name: Unicapital Securities, Inc.

- If you reside outside the Philippines, we suggest making a remittance to your local bank account and making a mobile or online bank transfer from your local bank account to the bank account of Unicapital Securities, Inc. for faster crediting purposes. If a local bank account is not available, below are the details needed for remittance transactions:

Send your proof to equities@unicapital-inc.com after making a successful transaction.

Yes, but we can only transfer the shares of stocks. To do this, you need to make a withdrawal request from the originating broker and then a funding transaction to the recipient brokerage firm if you also wish to transfer the buying power or cash balance. The transaction is called EQ Trade. The EQ trade requirement depends on every brokerage firm. Some brokerage firms require their clients to fill out a form, while for others, an email or letter of instruction sent via email will suffice. Either way, the recipient brokerage firm should receive a copy of the filled-out form or the email of the letter of instructions. You may send your EQ trade instructions to equities@unicapital-inc.com. We may treat the email or letter of instructions for EQ Trade as an initial investment for new account applications.

We will upload the purchase and sales invoices to your UTrade account on the next trading day. Likewise, we will also upload your statements of accounts after each month ends. Once you log in, you will have the capability to view or download these documents. It is necessary to have a PDF viewer, such as Adobe Acrobat, installed on the device where you logged in.

To execute your withdrawal request:

Log in to your account > Services > Withdrawal.

To check your withdrawal status and history:

Log in to your account > Services > Withdrawal > Withdrawal History.

Withdrawal requests will undergo a processing period of two to three business days. We will directly deposit withdrawal checks into the bank account you provided when opening your trading account. If you need to update your bank details on record, please reach out to our Client Support.

Stock Investment Program

SIP is a peso-cost averaging facility that proves to be a smarter way and better alternative to keeping your money in the bank. The amount you invest in the SIP doesn’t have to be a big one, it won’t break your bank and yet, you know that by investing regularly, you’ll be reaping the benefits later on.

UTrade will recommend a basket of stocks chosen based on fundamental research. Based on this, choose the stocks from industries which interest you. With UTrade’s SIP facility, you can easily nominate the stocks you want to enroll. Next, decide how much you want to invest or set aside for the SIP then determine how long you intend to be making the regular investment, depending on your long-term goal. Before your next purchase is due, you will conveniently receive an email reminder from UTrade.

The SIP program is a good way for new and long-term investors to start investing in the stock market. It can also be beneficial to those who have no time to watch the market on a daily basis or are not comfortable with investing a big amount of money in just one go.

You can easily start investing in SIP through your UTrade account. No account yet? Refer to the account-opening instructions under UTrade’s FAQs to start.

Mutual Funds

UTrade by Unicapital Securities, Inc. is a licensed mutual fund distributor and registered with the Securities and Exchange Commission (SEC). The funds we currently distribute via the UTrade platform are the following:

- ATR Asset Management, Inc (ATRAM)

- BPI Investment Management, Inc. (ALFM)

- First Metro Asset Management, Inc. (FAMI)

- Philam Asset Management, Inc. (PAMI)

- Philequity Asset Management, Inc. (PEMI)

- Sunlife Asset Management, Inc. (SLAMCI)

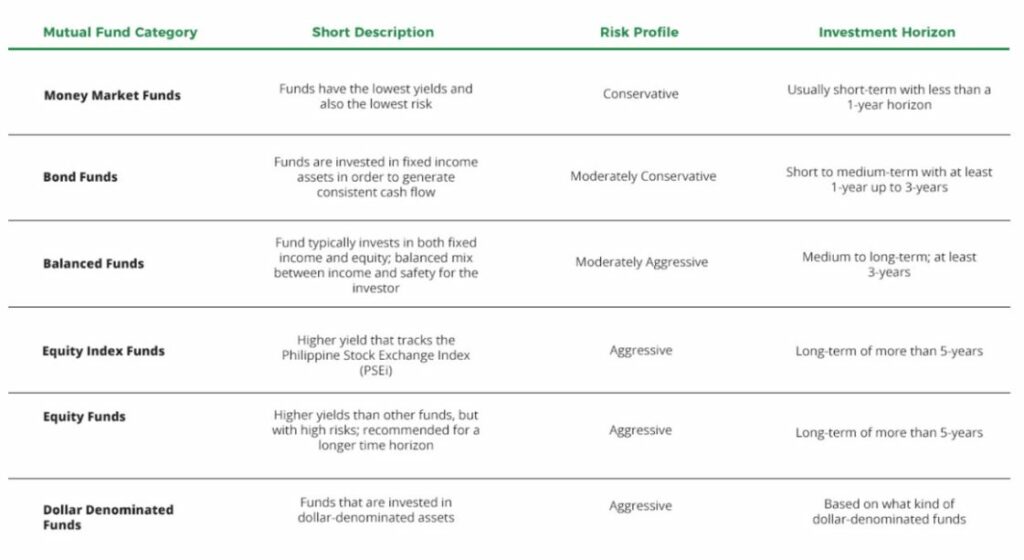

There are different types of funds which you can invest in depending on your financial goals and needs. The below are the different types of fund which you invest in through UTrade:

Returns are determined by the movement in Net Asset Value Per Share (NAVPS). An increase in NAVPS means that you can redeem the shares of a mutual fund for a higher value. You may also earn money through dividend payouts from the mutual fund itself.

With UTrade, there is NO sales load charged with each subscription regardless of initial investment or additional investment. There are likewise no redemption fees charged by UTrade.

To start investing in mutual funds, go to “EXCHANGE” then “MUTUAL FUND” to see all available mutual funds to invest in. For first-time investors, a suitability questionnaire will automatically prompt to be answered. The questionnaire is designed in order to assess your risk profile as an investor and will automatically show recommended mutual funds to be invested in. This, however, will not limit you to investing in these funds. The investor may opt to show all funds available via a filter and sort function available.

Fixed Income

If you are interested in investing, you can do so by filling out the contact form here.

If you’re ready to submit an application, you may download the application form here. Print, fill out, and collate together with the necessary requirements.

Once everything is complete, send us your complete application and documents via:

- Email at treasury@unicapital-inc.com

- Deliver at 3rd Floor, Majalco Building, Benavidez cor. Trasierra streets, Legaspi Village, Makati, 1229

The requirements for INDIVIDUAL investors are the following:

- Unicapital Account Opening Form

- Unicapital Signature Cards

- 2 Valid and Government Issued IDs (to sign 3x beside the ID)

- Data Processing Consent and Warranties Form (Unicapital Inc.)

- FATCA Form

- PDTC Specimen Signature Document (for Corporate Bonds)

- PDTC Investor Registration Form (for Corporate Bonds)

- BTR NROSS Special Power of Attorney (for Government Securities)

- BTR Investor’s Undertaking (for Government Securities)

CORPORATE/INSTITUTIONAL investors are the following:

- Unicapital Account Opening Form

- Unicapital Signature Cards

- Valid and Government Issued IDs of the signatories (2 per signatory; signatories to sign 3x beside the ID)

- Articles of Incorporation (certified true copy by Corporate Secretary)

- By-Laws (certified true copy by Corporate Secretary)

- GIS (certified true copy by Corporate Secretary)

- Secretary’s Certificate/Board Resolution (authorizing the Corporation to invest in fixed income products with Unicapital Inc.)

- Secretary’s Certificate (stating the Corporation’s authorized signatories)

- PDTC Specimen Signature Document (for Corporate Bonds)

- PDTC Investor Registration Form (for Corporate Bonds)

- BTR NROSS Special Power of Attorney (for Government Securities)

- BTR Investor’s Undertaking (for Government Securities)

Additional documents may be required depending on the issuance. The above-mentioned forms are available and can be downloaded here.

The minimum investment varies and will depend on the security.

Interest payments or coupon payments will be paid depending on the security which you invested in. These can be paid monthly, quarterly, semi-annually, or annually.

The tax on interest or coupon for a regular investor is 20%. For tax-exempt institutions, the tax rate is at 0%.

We accept the following IDs:

- Passport

- Driver’s License

- Digitized SSS/GSIS ID

- Unified Multi-Purpose ID (UMID)

- Voter’s ID

- Professional Regulations Commission (PRC) ID

- Postal Identity Card

- Senior Citizen’s ID

- Government office ID – if employed

- PhilHealth ID

- Pag-IBIG ID

- Tax Identification Number (TIN)

- Seaman’s Book

- OFW ID

- OWWA ID

- Police or NBI Clearance

You may issue cheques payable to Unicapital, Inc. which can be picked up from your residences or office or you may deposit or transfer funds to the account below:

- East West Bank

- Branch: Salcedo

- Account Name: Unicapital, Inc.

- Account Number: 200001686622

Please send a copy of the deposit slip or transfer confirmation to treasury@unicapital-inc.com.

We always make sure that our clients get the best price and best execution for their investment needs. You can call, email, or send a message to our salesmen for live prices and execution of your buy and sell instructions. Please see below contact details of our fixed income market salesmen for Unicapital Inc:

- Marie Angela M. Hing

Email: mmh@unicapital-inc.com

Phone: +632-8892-0991 - Ma. Lourdes C. Monedero

Email: lcm@unicapital-inc.com

Phone: +632-8892-0991 local

You can also send an email to treasury@unicapital-inc.com.

For investments in Corporate Bonds, the settlement date is 3 banking days (T+3) after the transaction date. For investments in Government Securities, the settlement date is usually 1 banking day (T+1) after the transaction date.

For transactions done on or before 11:30 AM, the transaction date is on the same day. For transactions done after the cut-off, the transaction date is the next banking day.

For investments in Corporate Bonds:

- Broker’s Fees

- If tenor is one (1) year or less, fee is a flat fee of ten basis points (10bps) of the face value multiplied by the remaining term/360

- If tenor is over one (1) year, fee is dependent on the volume

- Fixed Income Transaction Fee

- If tenor is one (1) year or less, fee is a flat fee of 25 basis points (25bps) of the face value multiplied by the remaining term/360

- If tenor is over one (1) year, fee is a flat fee of 25 basis points (25bps) of the face value

- Other Charges (as needed):

- Account-Opening Fee: Php100

- Transfer Fee: Php100/side (buyer and seller)

- Request for Certification: Php200/account

- Certificate of Correction: Php100/per BP ID

- Request for Reprint: Php50

- Depository Maintenance Fee: 0.50 bps per annum of face amount of total Depository securities account

- Uplift Fee: 0.1bps of face amount

- Non-transfer Fee: Php100 (transferor side)

- Broker’s Fees

- If tenor is one (1) year or less, fee is a flat fee of ten basis points (10bps) of the face value multiplied by the remaining term/360

- If tenor is over one (1) year, fee is dependent on the volume.

- Other Charges (as needed):

- Request for Certification: Php200/account

- Certificate of Correction: Php100/per BP ID

- Request for Reprint: Php50

- Request for Reports: Php100/report

Need more help?

What We Do

Products and Services

LOREM IPSUM

Investment Banking FAQ

Lorem ipsum dolor sit

Lorem ipsum dolor sit amet, vis an nihil tation doctus, mel ne iriure accusam evertitur. Te omnes repudiandae pri, dolores appetere incorrupte id nam. Mundi doctus mel ad, modo tempor iudicabit vix eu. Duo adhuc noluisse incorrupte.

Lorem ipsum dolor sit amet, vis an nihil tation doctus, mel ne iriure accusam evertitur. Te omnes repudiandae pri, dolores appetere incorrupte id nam. Mundi doctus mel ad, modo tempor iudicabit vix eu. Duo adhuc noluisse incorrupte.

Lorem ipsum dolor sit amet, vis an nihil tation doctus, mel ne iriure accusam evertitur. Te omnes repudiandae pri, dolores appetere incorrupte id nam. Mundi doctus mel ad, modo tempor iudicabit vix eu. Duo adhuc noluisse incorrupte.

Lorem ipsum dolor sit amet, vis an nihil tation doctus, mel ne iriure accusam evertitur. Te omnes repudiandae pri, dolores appetere incorrupte id nam. Mundi doctus mel ad, modo tempor iudicabit vix eu. Duo adhuc noluisse incorrupte.

Lorem ipsum dolor sit

Lorem ipsum dolor sit amet, vis an nihil tation doctus, mel ne iriure accusam evertitur. Te omnes repudiandae pri, dolores appetere incorrupte id nam. Mundi doctus mel ad, modo tempor iudicabit vix eu. Duo adhuc noluisse incorrupte.

Lorem ipsum dolor sit amet, vis an nihil tation doctus, mel ne iriure accusam evertitur. Te omnes repudiandae pri, dolores appetere incorrupte id nam. Mundi doctus mel ad, modo tempor iudicabit vix eu. Duo adhuc noluisse incorrupte.

Lorem ipsum dolor sit amet, vis an nihil tation doctus, mel ne iriure accusam evertitur. Te omnes repudiandae pri, dolores appetere incorrupte id nam. Mundi doctus mel ad, modo tempor iudicabit vix eu. Duo adhuc noluisse incorrupte.