Filipinos are known for being disciplined savers. We fill coin banks, join cooperatives, open passbook accounts, and keep emergency cash in envelopes for “just in case.” Savings is part of our culture, often passed down through family advice like “mag-ipon ka para may masasandalan.”

But when the conversation shifts from saving to investing, many become hesitant. We hear phrases like “baka malugi,” “mahirap intindihin,” or “pang-mayaman lang ‘yan.” Even those who save diligently often stop short of taking the next step that could actually grow their money. This isn’t about blame, it is about understanding a mindset shaped by fear, caution, and limited exposure to investing.

Why Many Filipinos Stop at Saving

The gap between saving and investing starts in our beliefs. Saving feels safe. It feels familiar. You put money in a bank and you know it is there. Investing, on the other hand, feels like stepping into the unknown. Stories of scams, confusing financial terms, and the fear of losing hard-earned money all contribute to a sense of uncertainty.

This cautious mindset, while understandable, limits financial growth. Savings alone often cannot keep up with rising prices and inflation. A person can save for many years and still feel like their money is not growing fast enough to support long-term goals. Without taking calculated risks, even the most hardworking savers can find themselves stuck in the same financial place.

When Understanding Starts, Growth Follows

The turning point comes when Filipinos realize that investing is not about gambling or luck. It is about knowing how money works and allowing it to grow over time. Many who shifted from saving alone to saving and investing did not do it out of bravery, they did it out of understanding.

Once they learned how investing works, how small amounts can grow consistently, and how time multiplies returns, they began to see investing as a tool rather than a threat. And that shift has changed financial futures. Imagine families who invest early for their children, or young professionals who start small and watch their money grow through the years. These are real stories of progress built on learning, not on chance.

Investing Is Not Just for the Wealthy

One of the biggest misconceptions is that only people with large savings can invest. Today, that is no longer true. Digital platforms have made investing more accessible than ever. You can begin with small amounts, learn at your own pace, and grow gradually.

Investing is simply another way of empowering your future. It is not about being rich. It is about giving your money the chance to work for you while you continue working for your goals. The earlier you start, the more time your investments have to grow even if you begin with small, consistent amounts.

Let UTrade Guide Your Next Step

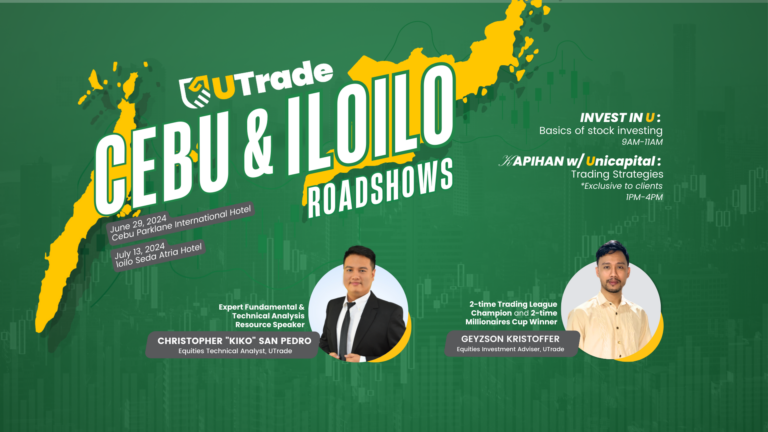

This is where UTrade comes in as a partner for every Filipino ready to cross the bridge from saving to investing. Whether you are starting with a small budget or ready to build a long-term portfolio, UTrade offers tools that make investing simple and approachable.

With the Stock Investment Program (SIP), you can invest regularly without needing a big amount upfront. UTrade’s beginner-friendly platform and free educational webinars help you understand the market and build confidence as you grow. Little by little, you begin to see that investing is not something to fear — it is something to learn and embrace.

Your money deserves more than safety, it deserves growth. Don’t just save. Start growing your story with UTrade today.

UTrade, is the online stock trading platform of Unicapital Securities, Inc., which offers smooth online stock trading and investing. With real-time market access, customizable layouts, and comprehensive charting, our platform provides convenience and a wide range of investment options, including stocks and mutual funds.

Unicapital Securities, Inc. (USI), under the Unicapital Group of companies, is a leading brokerage house duly licensed by the Securities and Exchange Commission and is a member of the Philippine Stock Exchange.