Short-Term Business Loan Philippines

Fast and easy business loans for micro, small and

medium enterprises

Short-Term Business Loan Philippines

Fast and easy business loans for micro, small and

medium enterprises

What is a Short-Term Business Loan?

A short-term business loan is a type of financing designed to address the immediate capital needs of a business. It’s an excellent solution for covering essential expenses like payroll, inventory, or unforeseen costs. Unlike long-term loans, a short-term loan features a quicker processing time, fewer documentary requirements, and a shorter repayment period, typically ranging from a few months to a couple of years. This makes it a practical and accessible tool for businesses that need fast access to funding.

Introducing ULoan’s Short-Term Business Loan

ULoan Business offers its own version of a short-term business loan, tailored for micro, small, and medium enterprises in the Philippines. Our loan facility provides a fast and straightforward way for businesses to secure the financing they need to seize opportunities or manage unexpected financial demands. With a shorter repayment period of six to twenty-four months, our loan is easier to obtain and manage than traditional long-term loans.

Fast Processing

Easy Application

Superior Customer Service

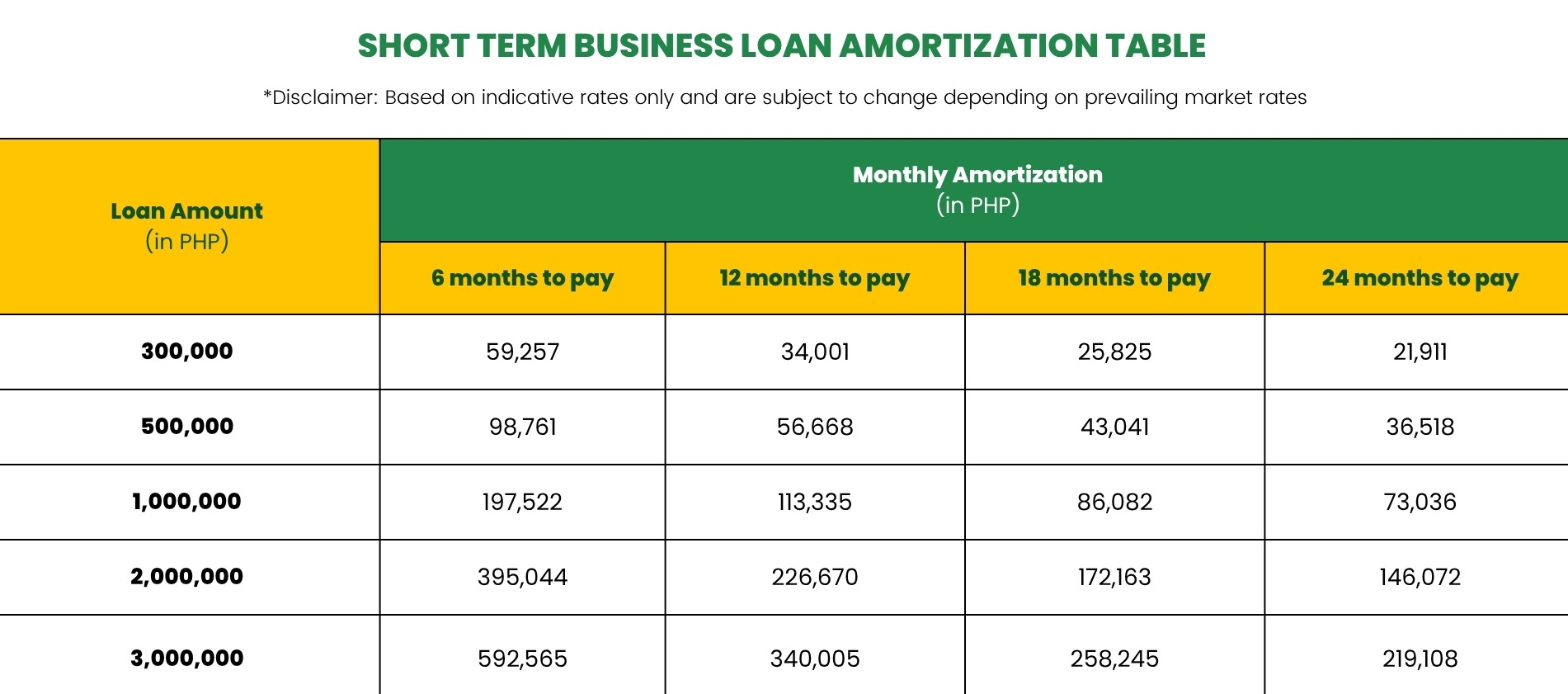

Loan Overview

Loanable Amount

PHP 300,000 to PHP 3,000,000

Payment Terms

Minimum of 6 months and maximum of 24 months

Interest Rate

As low as 3% per month

Advantages of Short-Term Business Loan

Fast Processing: We understand the urgency of your business needs. Our efficient process ensures you get a quick decision and access to funds without unnecessary delays.

Easy Application: The application process is designed to be simple and hassle-free, with minimal documentary requirements to save you time and effort.

Superior Customer Service: Our dedicated team is committed to providing excellent support, guiding you through every step of the loan process.

Eligibility Requirements

- Borrower must have an existing business operating for at least three (3) years.

- Borrower must have an active checking account for at least six (6) months, with at least PHP250,000 monthly transactions.

- Business must be registered with DTI or SEC and must have a Mayor’s Permit.

- Business must be located and operating within the following areas:

- Metro Manila

- Batangas

- Laguna

- Cavite

- Rizal

- Pampanga

- Bulacan

- Nueva Ecija

- Quezon