Investment Banking

We are fully committed to your company’s success by delivering sound financial advice and innovative financial solutions.

Investment Banking

We are fully committed to your company’s success by delivering sound financial advice and innovative financial solutions.

Through our Corporate Finance Group, we engage in the following Investment Banking activities.

Our Investment Banking Services:

Strategic and Financial

Advisory

We offer an in-depth understanding of the capital markets to effectively translate our resources into actionable financial strategies and to develop innovative solutions best-suited for your unique situation.

Underwriting and Private Placement

Through our extensive experience, we are able to execute various capital-raising activities – initial public offerings, follow-on offerings, debt issuances, private placements, and other transactions.

Mergers, Acquisitions, and Divestitures

We provide advisory and investment banking services on buy-side and sell-side M&A transactions to various local and regional companies, government agencies and private investors.

Corporate

Restructuring

We can give you hands-on assistance in reorganizing your legal, ownership, operational and other structures of your company with the goal of improving its liquidity, financial condition, or operating performance.

Project Finance

Unlike traditional balance

sheet-based financing, our Project Financing service involves capital-intensive projects that we evaluate based on estimated future cash flows.

At Unicapital, we are proud of the name we’ve created for ourselves in the industry as a leading independent investment bank in the Philippines – helping many businesses and institutions in raising capital, providing expertise in financial advisory transactions, engaging in mergers and acquisitions and offering ancillary services including post-transaction support.

Building on our network of client relationships and our in-depth industry knowledge, we are also fully committed to delivering sound financial advice, innovative financial solutions, superior transaction execution and access to the Philippine debt and equity capital markets.

Investment Banking’s Track Record of Success

Awards and Recognition

Seasoned Team of Professionals Providing Execution Certainty

Experience in Diverse Industries and Transactions

Award-Winning Innovative Solutions

Our Team

President & CEO

Managing Director

Senior Vice President

Latest Deals

CO-LEAD MANAGER 2016

P10 Billion Preferred Shares Offering

ISSUE MANAGER AND

LEAD UNDERWRITER 2015

P207 Million Initial Public Offering

SOLE DOMESTIC LEAD MANAGER AND UNDERWRITER 2015

P8 Billion Stock Rights Offering

FINANCIAL ADVISOR 2015

Fairness Opinion and Valuation Report

ISSUE MANAGER AND LEAD UNDERWRITER 2014

P1.16 Billion Initial Public Offering

ISSUE MANAGER AND LEAD UNDERWRITER 2012

P5.2 Billion Initial Public Offering

FINANCIAL ADVISOR 2012

P1.16 Billion Initial Public Offering

ARRANGER AND SELLING AGENT 2011

P1.25 Billion Unsecured Subordinate Debt

Latest News

Unicapital Supports PBB in Completing PHP 500 Million SRO

Unicapital Supports Alternergy in Raising PHP1.6 Billion Through This Year’s First IPO

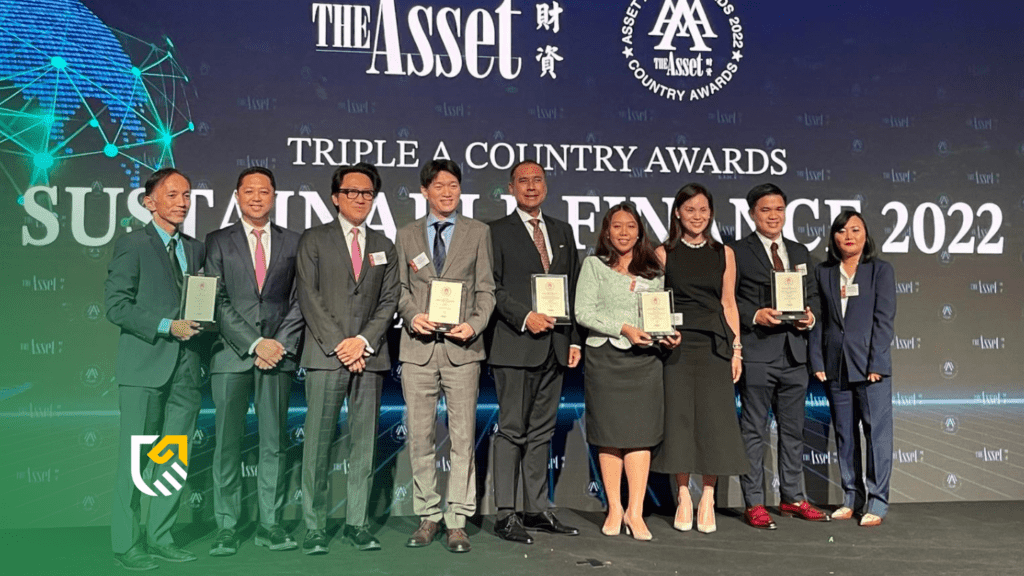

Unicapital wins 2022 Asian Banking & Finance award for ‘Innovative Deal’

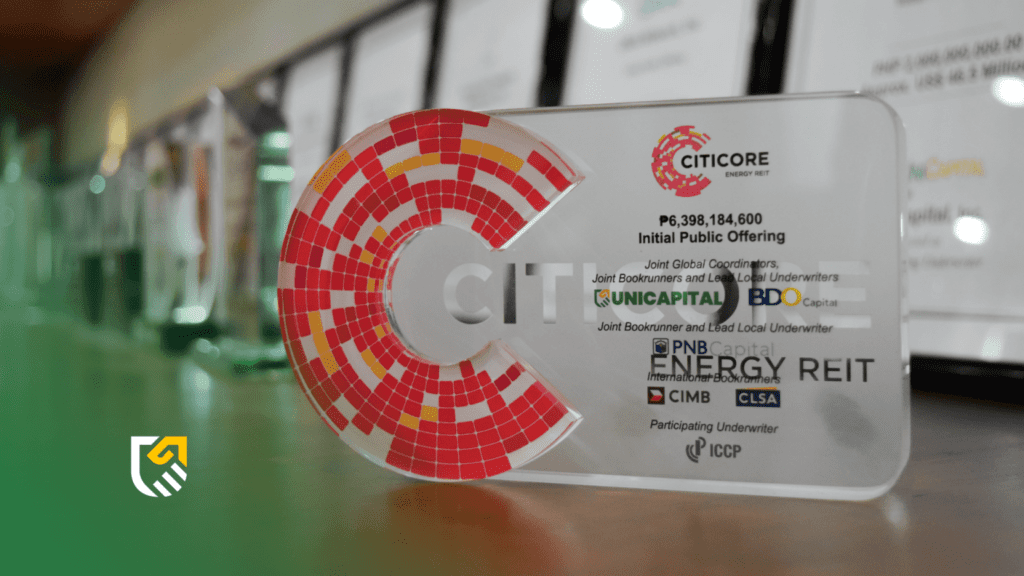

The Asset cites Unicapital for a major role in the PH’s Best IPO of 2022

Ready to avail of our

Investment Banking Services?