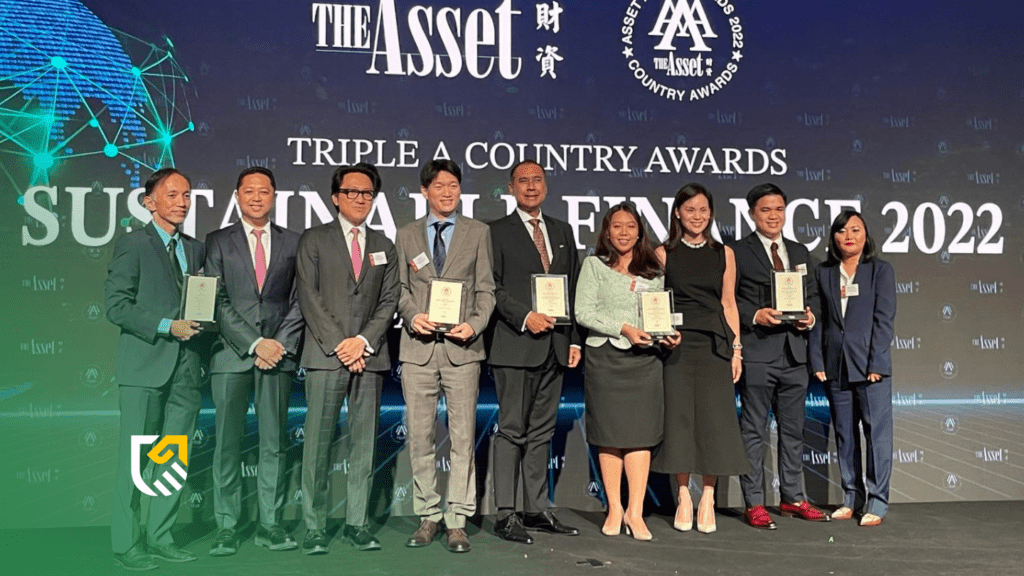

Unicapital Inc. was cited during the recent The Asset Triple A Country Awards for Sustainable Finance 2022 for being the Issue Manager and in the P6.4-billion Initial Public Offering (IPO) of Citicore Energy REIT Corporation (CREIT).

Citicore’s was named as the “Best IPO in the Philippines” during the awards.

According to The Asset, CREIT “is the first renewable energy-focused real estate investment trust (REIT) in the first Philippines and the first non-real estate company to list via REIT in the Philippine Stock Exchange.”

As such, it was structured differently from other local REITs as all deposited properties are leased out to renewable energy generators.

“We are honored to be instrumental in realizing this deal for Citicore, which has been very significant in supporting further the growth of our renewable energy sector,” Unicapital Group Chief Executive Officer Jaime J. Martirez said.

“This recognition is a testament to our commitment to delivering consistent excellence in providing the best investment banking services, including trading, underwriting, and distribution of fixed income and equity securities in the Philippines capital markets,” the company CEO said.

This is the second time the Unicapital-led offering was recognized after the Citicore IPO also bagged the “Innovative Deal of the Year” at the recent Asian Banking & Finance Corporate and Investment Banking Awards.

Being one of the leading independent investment houses in the country, Unicapital has carved out a name for providing corporate finance and advisory services in the Philippines.

Supporting the capital markets

Martirez pointed out that the capital markets remain to be a feasible option for companies to raise funds for their long-term expansion plans.

“We hope that we will be able to contribute more to the deepening of the Philippine equity capital markets,” he said.

Unicapital has always been dedicated to fueling the growth of emerging companies in the Philippines by providing them access to the capital markets. Unicapital is a duly licensed full-service investment house that aims to provide the widest array of finance and investment-banking related products and services.

The Asset’s annual Triple A recognition, now more than 20 years old, represents the industry’s most prestigious awards for banking, finance, treasury and the capital markets. As the financial multi-media group with the widest reach among Asian issuers and global institutional investors, The Asset has unparalleled insight, which forms the foundation of its annual awards.

Issuers and investors, who constitute the bulk of The Asset’s readership base, are consulted in the process either through the Asset Benchmark Surveys or in the course of the Triple A presentation with financial institutions; their views and comments are taken into consideration and given weight in addition to the other selection criteria outlined in the rulebook.

The Asset also recognizes a number of regional issuers and advisers for their roles in leading landmark deals in Southeast Asia, North Asia, and South Asia.