What is Investment Banking?

Investment banking keenly focuses on the provision of finance for the development of enterprises and corporations—fulfilling their financial needs and raising their capital. In this blog, we will dive deeper and see how investment banking plays a vital role across industries.

Here are the eight key concepts you need to know about investment banking.

Bonds

Bonds are also known as debt securities issued by a company to investors. These are commonly issued to raise money. Investors lend money to a company for a certain period in exchange for interest.

Shares

Shares are simply one’s percentage of ownership in a company’s financial assets. These are units of stock shared by individuals, commonly known as shareholders. These are often carried out when a company aims to raise its capital.

Capital increase

A capital increase simply means the company aims to raise its share capital. Selling and increasing the number of goods produced is one of the best ways to increase capital. This is often done directly.

Initial public offering (IPO)

An initial public offering usually happens when a private company sells shares of stock to the public. This kind of investment allows companies to expand and transition shares from private ownership to public ownership.

Mergers and acquisitions

Merger and acquisition strategy simply refers to transferring control from larger corporations to smaller corporations. This is where large companies buy shares from small businesses and dominate their transaction process to come up with a new venture.

Corporate loan

Known as a transaction made between a bank and a company. A corporate loan is also a type of loan known to be used for the welfare of the business rather than for personal use.

Project Finance

This is the type of loan that solely relies on a project’s cash flow. It is also long-term capital investment. The best example of this is a real-estate project, which commonly takes a long time to furnish.

Trade finance

Trade finance is introducing third-party borrowers to prevent payment risk—i.e., buyer and seller, credit agencies, traders, etc.

End note

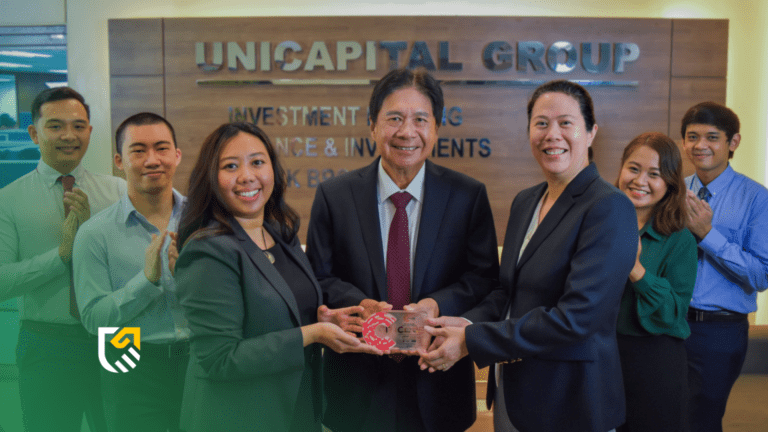

Investment banking is something that is both risky and helpful for companies. If you are still hesitant about how it works, reach out and start investment banking with Unicapital.