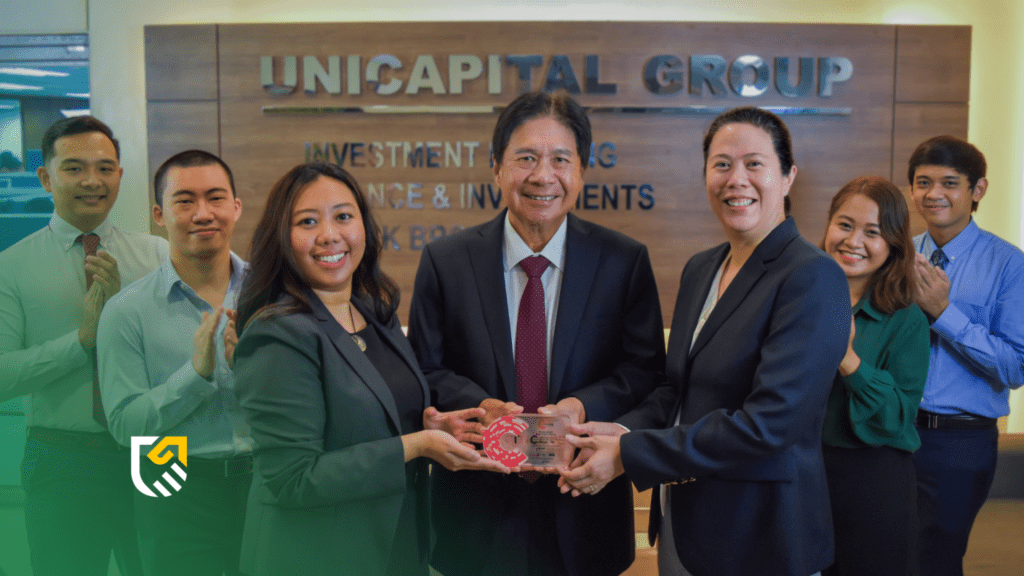

Manila, August 22, 2023 – Unicapital Inc., in collaboration with a consortium of prominent financial institutions, emerged victorious at the 8th IHAP Awards. The esteemed group, which includes BDO Capital & Investment Corporation, PNB Capital and Investment Corporation, CLSA Limited, CIMB Investment Bank Bhd, and Investment & Capital Corporation of the Philippines, clinched not one but two prestigious awards: the Best Large Cap – Equity Deal and the highly-coveted Deal of the Year for 2022. These accolades are in recognition of their instrumental role in orchestrating the groundbreaking initial public offering (IPO) of Citicore Energy REIT Corporation.

The Investment House Association of the Philippines (IHAP) Awards stand as a testament to excellence within the financial industry of the Philippines. They aim to recognize noteworthy investment banking deals and outstanding investment houses which have contributed to the growth of Philippine companies, the economy, and the capital markets. For the IHAP Awards 2023, deals and transactions considered were for full year 2021 and 2022 for the 7th and 8th edition, respectively. Through these awards, IHAP seeks to bring into the forefront highly notable developments in the Philippine capital market and in so doing, enhance the role of the capital markets in contributing to the sustainable and equitable growth of the economy.

The jewel in the crown of Unicapital’s achievement, the Citicore Energy REIT Corporation IPO was a monumental transaction that redefined industry standards and showcased the power of strategic collaboration. This recognition affirms Unicapital Inc.’s position as a trailblazer in the realm of finance and underscores the transformative impact they bring to the market.

Deal highlights:

- On February 22, 2022, Citicore Energy REIT Corporation (“CREIT”) conducted an IPO for 2,509,092,000 common shares (with the over allotment option fully exercised) at a price of PhP2.55/share, the first renewable-energy focused REIT in the Philippines.

- The offering raised PhP6.4 Billion (USD125M) in proceeds for the issuer which were used towards purchasing several properties in Bulacan and South Cotabato and to partially fund its 21.2 MW renewable energy development pipeline.

- The offering was oversubscribed as a result of its innovative deal structure, attractive pricing, defensive stock positioning with a competitive 6.6% dividend yield, strong business fundamentals, and opportune timing prior to the May 2022 National Elections and Ukraine-Russia war.

- The offer challenged market volatility in an environment of COVID lockdowns, rising inflation and interest rates, Ukraine-Russia tensions and the upcoming Philippine elections.

- The offering was given a ‘Dark Green’ assessment by CICERO Shades of Green for the Company’s long-term vision of a low carbon and climate resilient future, a first in Southeast Asia.