Business Loan

Specifically designed for business endeavors, business loans provide capital to businesses. They provide many advantages that personal financing cannot, such as tax deductions and low-interest rates.

Business term loans have a larger limit than personal loans, which means you can borrow an enormous amount for your needs. This approach will be beneficial if you’re funding a major business project, such as expanding to other markets, new business facilities, or new technology upgrade.

In addition, the interest payable on a business loan is often tax-deductible. You might want to check the interest limit and eligibility before applying for one.

Receivables Discounting

Discounting accounts receivables is a method of securing a loan against an organization’s receivables. The practice is sometimes known as “factoring.” Although the receivables themselves are shown as assets, the loan against them is shown as a liability because the lender must be repaid.

Through receivable discounting, companies can borrow money based on the value of their receivables (the unpaid invoices for goods and services), using the money to pay for expenses.

Revolving Credit Line

The principle of revolving credit is very similar to a credit card. Many institutions refer to a revolving credit agreement as a revolving line of credit. A lending institution grants you credit so you can make purchases anytime you need them.

Many small businesses and corporations use revolving credit to finance capital expansion or cash flow problems.

In some cases, individuals use this to cover large-scale expenses such as house renovations, and medical bills or protect against overdrafts on demand deposits or checking accounts.

Ready to Apply for a Loan?

Whether you’re a start-up or an established company, you have a number of options when applying for loans and credits for your business.

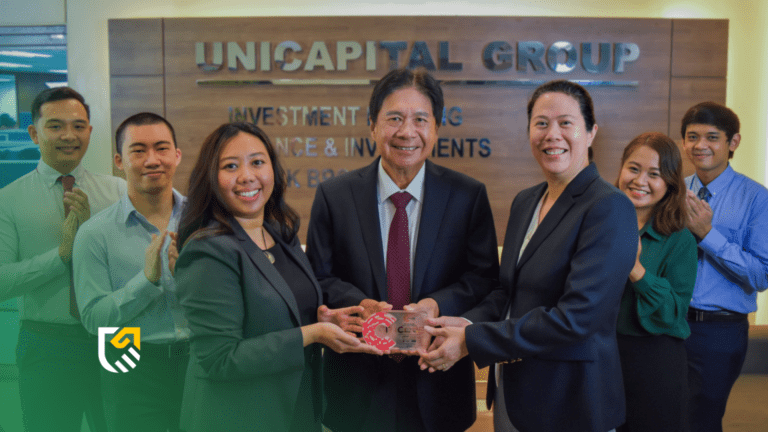

And if you’re looking for someone who can help, Unicapital can be your best option. Unicapital is the leading independent financial service in the Philippines. It provides different loans and credits for businesses to maximize their business loan potential.